Trades of the Decade (Update Oct.12.21)

Trades of the decade Apr.13.21:

I want to check these next year to see how I did.

If the market crashes because of AMC and GME, I will earn life changing money.

Company

Stock/Option

Expiry

Price of option

Average purchase price

AAPL

Put Option

Jun 17 2022

60

0.93

AMC

Stock

9.255

AMC

Call Options

Too many to count

ARKK

Put Options

Jan 21 2022

47.96

1.25

GME

Stock

141.01

GME

Call Option

Jan 21 2022

950

8.10

KALA

Call Option

Jul 16 2021

10

2.50

ONCT

Call Option

Jul 15 2021

5

4.40

SPXU

Call Option

Jan 20 2023

15

15

Call Option

Jan 21 2022

18

10

SQQQ

Call Option

Jan 21 2022

1

15.15

TSLA

Put Option

Dec 17 2021

100

1.44

Let’s check in on these predictions in a year from now and see what happens.

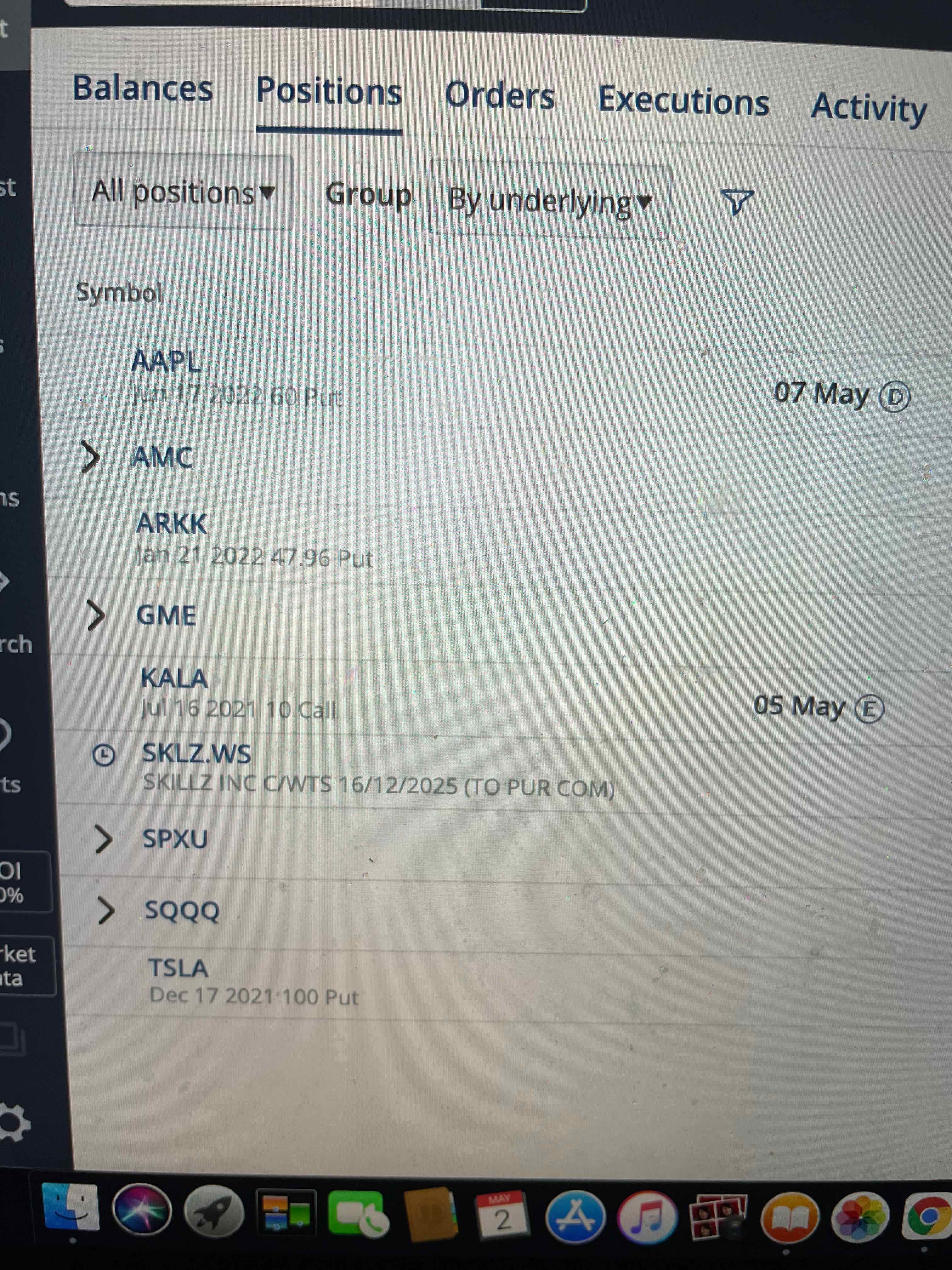

Update May.2.21:

Proof of my portfolio

Update - May.29.21

I added FAZ options to my portfolio (3x inverse leveraged ETF for the financial sector) as I think some of the banks are going to collapse.

Update - Oct.12.21

I added UVXY to my portfolio as a leveraged bet on the VIX exploding with volatility the next year.

Added GDXJ because I think gold explodes up when the deflationary bubble comes, especially as commodities and precious metals go higher.

Took a flier on MMAT (Metamaterials), a Canadian company because of interesting intel that they're shorted into oblivion but can't go bankrupt. We'll see.

Added a BBBY put for the same reason, but they missed their latest earnings so the shorts won out. Can't win them all.

Bought a ton more GME and reshuffled from AMC because I think GME is the nuke to the market while AMC is its smaller brother. Both will do well so just wanted to diversify risk.

KALA and SKLZ are obviously gone.

I'm going all the way. History will see if I'm right or not.